Despite 2025 being widely framed as a breakthrough year for institutional crypto adoption, the number of Bitcoin (BTC) millionaire addresses declined sharply over the course of the year, according to Finbold’s latest 2025 Cryptocurrency Market Report.

The analysis shows that Bitcoin lost over 7,000 millionaire wallets in 2025 as wealth concentrated among larger holders.

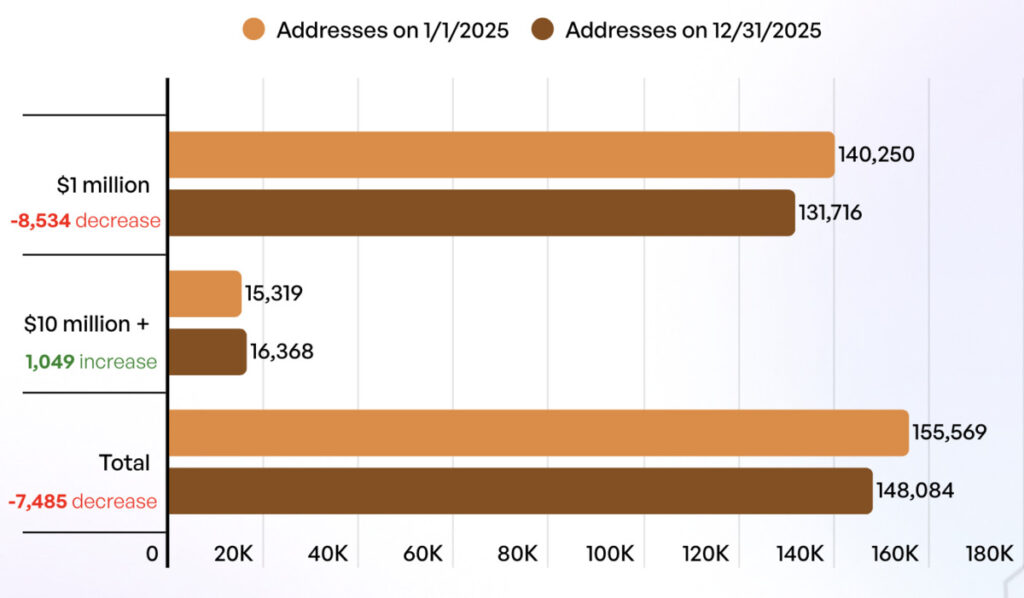

Between January 1 and December 31, 2025, the number of Bitcoin addresses holding at least $1 million fell by 7,485, leaving a total of 148,084 millionaire addresses by year-end.

The data also revealed that Bitcoin millionaire addresses declined from 155,569 at the start of 2025 to 148,084 by December 31, even as spot Bitcoin ETFs attracted billions in inflows throughout the year.

Addresses holding $10 million+ rise

Within that total, addresses holding $10 million or more actually increased, rising from 15,319 to 16,368, suggesting that wealth concentration intensified even as mid-tier millionaire wallets declined.

On average, the net loss equates to approximately 21 Bitcoin millionaire addresses disappearing per day over the year.

It is important to note that a single individual can control multiple Bitcoin addresses, meaning wallet counts do not map one-to-one with unique individuals. Still, the trend offers a useful proxy for changes in on-chain wealth distribution.

Q4 2025’s reversal wipes out earlier gains

The decline was not linear. By the end of Q3 2025, Bitcoin had added a net 20,688 millionaire addresses year-to-date, driven by strong price momentum earlier in the year.

However, the final quarter saw a pronounced reversal, wiping out earlier gains and pushing the full-year figure into negative territory. The data suggests that profit-taking, portfolio rebalancing and late-year volatility played a significant role in the drawdown.

The contraction in millionaire addresses occurred even as Bitcoin remained firmly embedded in institutional portfolios. Bitcoin began 2025 trading near $92,600 and ended the year closer to $87,100, reflecting a net price decline despite sustained demand through regulated investment vehicles.

Read: Real-world asset tokenization faces $1.3 billion losses from blockchain inefficiencies

Institutional adoption accelerates

The divergence highlights a key theme of 2025, while institutional adoption accelerated, price appreciation failed to keep pace with earlier expectations, squeezing mid-range holders more than large allocators.

Compared with 2024, which saw 56,325 new Bitcoin millionaire addresses, an average of 154 per day, 2025 marked a clear shift in on-chain wealth dynamics. Rather than broad-based wealth creation, the year was characterized by consolidation at the top, with larger holders increasing their footprint while smaller millionaire wallets exited.

Finbold’s analysis suggests that 2025 was less a year of mass enrichment and more a period of redistribution, reinforcing the view that Bitcoin’s maturation increasingly favors scale, patience, and long-term capital over speculative cycles.