Bitcoin and Ethereum prices dropped sharply on Tuesday, amid escalating geopolitical risks from U.S. President Donald Trump’s renewed push for Greenland ownership and related tariff threats against European nations. Bitcoin fell 1.8 percent to $90,916.80 by early trading, while Ethereum declined 2.2 percent to $3,126.01, extending losses as investors fled speculative assets.

Bitcoin traded at $90,916.80, down 1.8 percent as of 01:39 ET, erasing mid-January gains and nearing year-start lows. Ethereum slipped to $3,126.01, a 2.2 percent retreat, with broader altcoins like XRP (-0.6 percent), BNB (-1.1 percent), and Solana (-1.3 percent) also under pressure.

Market data reflects heightened caution: Bitcoin’s 24-hour liquidations hit $260.32 million, following nearly $900 million earlier in the week, dominated by long positions. Ethereum’s discount in U.S. markets via Coinbase Premium Index underscores weak retail sentiment.

These moves align with CoinMarketCap stats showing Bitcoin’s $1.82 trillion market cap (down 2.1 percent) and Ethereum’s $374.88 billion (down 3.41 percent), with volumes at $35.31 billion and $22.63 billion respectively.

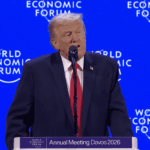

Trump’s remarks spark selloff amid national security concerns

President Trump’s Monday statement on discussing Greenland at Davos fueled the selloff, reiterating U.S. ownership calls for national security amid threats to tariff eight European nations. European leaders rejected demands and prepared retaliatory measures, amplifying uncertainty that saps crypto appetite.

Geopolitical tensions battered global markets, pushing traders toward safe-havens like gold over Bitcoin, now macro-sensitive. A delayed U.S. crypto regulatory bill—objected to by Coinbase over proposals—added regulatory overhang.

This spat compounds macro risks, with Trump’s tariff threats and potential military rhetoric mirroring past volatility triggers.

Read more: Crypto lending hits $74 billion as Bitcoin’s market cap eyes $2.5 trillion milestone

Testing support at $90,000 after failing to break $94,000 resistance

Bitcoin approached $90,000 support after failing $94,000 resistance, with bearish bias below $94,095 targeting $89,226. Liquidation cascades and U.S. discount trading signal oversold conditions but persistent downside risk.

Ethereum formed consolidation patterns near $3,126, vulnerable below $3,150 to $2,850, though transaction highs offer resilience. Memecoins like Dogecoin (+0.1 percent) and $TRUMP (+0.9 percent) bucked trends slightly after slumps.

Prediction markets favor Bitcoin under $94,000, reflecting caution amid these pressures.

Bitcoin, the pioneering decentralized currency from 2009, faces tests as a risk asset amid 19.97 million supply nearing cap. Ethereum’s smart contract ecosystem endures, post-2015 launch and upgrades, despite price woes.

Both benefit from ETF inflows ($2.17 billion weekly for Bitcoin) but suffer in uncertainty, highlighting crypto’s evolution from niche to macro proxy.