Bitcoin (BTC) is currently locked in a high-stakes tug-of-war with the $90,000 level. Despite a brief surge to $90,001.7 early Thursday, the digital asset is struggling to find the momentum necessary to turn this resistance into firm support. While global equities and tech stocks have rallied on easing geopolitical tensions, Bitcoin’s price remains stubbornly disconnected from the broader “risk-on” appetite. The cryptocurrency is currently trading at $89,853.30.

BTC stagnation

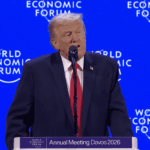

The primary obstacle for BTC continues to be the $90,000 mark. Even as President Trump’s decision to waive tariffs over Greenland sparked a rally in traditional markets, Bitcoin’s gains were fleeting.

- Retail exhaustion: Lingering trauma from the late-2025 “flash crash” has left retail buyers hesitant to chase prices at these levels.

- The “U.S. Discount”: According to Coinglass, Bitcoin continues to trade at a discount in U.S. markets, signaling a lack of domestic buying pressure compared to global exchanges.

- Treasury liquidation risk: Investors are closely watching “crypto treasury” companies. If BTC price weakness persists, these firms may be forced to sell holdings to cover debt obligations, creating a potential ceiling on price growth.

Bitcoin (BTC) has remained relatively flat, struggling to break through the $90,000 resistance level. In contrast, other sectors have demonstrated notable volatility and growth. Ether (ETH) has seen a slight increase of 0.97%, currently priced at $3,006.36, as it tests the important psychological floor of $3,000. Similarly, various altcoins, including XRP and SOL, have experienced gains ranging from 1.4% to 2%, recovering from recent weekly losses. Tech stocks, on the other hand, have achieved significant gains, outperforming cryptocurrency in the current market rally. Meanwhile, gold has tumbled in value, as investors have shifted their focus from safe-haven assets to stocks, effectively bypassing Bitcoin.

Decoupling trend

A notable trend is the decoupling of crypto-linked equities from the tokens themselves. While Bitcoin’s price remains stagnant, BitGo successfully priced its IPO above its indicated range, achieving a nearly $2 billion valuation. This suggests that while the “spot” price of Bitcoin is under pressure, institutional appetite for the infrastructure and companies surrounding the industry remains robust.

The failure of a $2.13 billion purchase by Strategy Inc. (MSTR) to trigger a sustained breakout above $90,000 is a cautionary signal for bulls. Furthermore, the loss of the $5 support level for the $TRUMP memecoin reflects a broader cooling of speculative sentiment.