Smart contracts, self-executing agreements embedded in blockchain technology, are poised to transform industries by automating transactions, reducing operational costs and improving efficiency across sectors ranging from finance to real estate.

However, rapid adoption of this technology carries significant risks. In 2016, a coding flaw in a Decentralized Autonomous Organization (DAO) smart contract on Ethereum resulted in the theft of $50 million worth of ether, highlighting the vulnerabilities inherent in digital agreements.

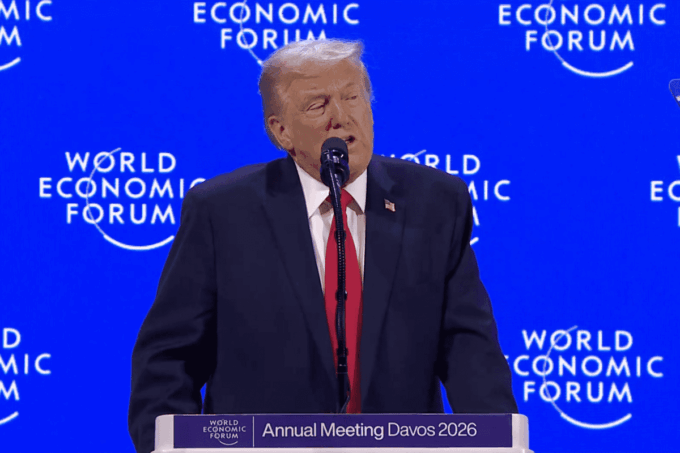

With the smart contracts market projected to reach $73 billion by 2030, expanding at a compound annual growth rate (CAGR) of 82.2 percent, addressing these cyber and legal risks has become an urgent priority, said the World Economic Forum in a recent report.

As adoption continues to accelerate and platforms such as Ethereum dominate the landscape, ensuring the security, reliability and legal robustness of smart contracts is critical to fostering broader trust and sustainable growth in this emerging sector.

Mitigating technical risks in smart contracts

The effectiveness of smart contracts hinges on the accuracy of their code and the security of the blockchain networks they operate on. Even small errors or oversights can result in serious consequences, including unauthorized access, misappropriation of funds, or unintended legal disputes.

To strengthen security and reliability, a multi-layered approach is essential. Formal verification tools play a key role in validating code correctness prior to deployment, while adherence to best practices and established development standards, combined with thorough auditing processes, can significantly reduce vulnerabilities.

Moreover, implementing advanced encryption methods and strict access controls helps protect sensitive contract data and transactions from malicious activity. Collectively, these measures mitigate technical risks and enhance the overall trustworthiness of smart contracts.

Evolving threats and legal uncertainty persist

Despite advances in blockchain security, smart contracts remain vulnerable, and exploits continue to result in substantial losses. In 2023, losses from decentralized finance (DeFi) hacks fell by more than 63 percent, according to Chainalysis, signaling progress in mitigating the impact of these attacks. However, the overall number of crypto-related hacks increased, underscoring that the threat landscape is evolving and remains a significant concern.

Beyond technical risks, legal ambiguity presents another major challenge. Smart contracts operate across jurisdictions with differing regulations, creating uncertainty over what is enforceable and how disputes should be resolved. For instance, if a contract is programmed to release payment upon project delivery but fails due to a coding flaw, it is often unclear who bears responsibility or how legal remedies can be pursued. Traditional contract laws do not always align neatly with the automated, code-based nature of smart contracts, leaving gaps in accountability and recourse.

Economic risks and security concerns

Smart contracts can be compared to a vending machine: you select a product, pay and receive it automatically. Normally, this process runs smoothly, but what happens if the price suddenly changes while your payment is in progress?

A real-world example occurred with MakerDAO during a major market crash. Rapidly falling prices caused automated contracts to execute in ways users had not anticipated, leading to unexpected losses. Similarly, in November 2017, the digital game CryptoKitties became so popular that it congested the Ethereum network, slowing transactions and driving up fees. These incidents illustrate how sudden market shifts and scalability limitations can undermine the reliability of automated systems and expose all network participants to risk.

Legal and regulatory uncertainty compounds these challenges. The passage of the Infrastructure Investment and Jobs Act in the U.S. in 2021 forced many blockchain projects to rapidly adapt to new compliance requirements. Such abrupt adjustments can destabilize operations and introduce security vulnerabilities, as projects rush to meet regulatory expectations while potentially overlooking technical weaknesses.

Read: UAE updates banking law to secure its spot as a global digital asset powerhouse

Securing the future of smart contracts

Smart contracts have the potential to transform the way transactions are conducted, offering more efficient and secure digital agreements. However, their path to widespread adoption is fraught with challenges, ranging from technical vulnerabilities and legal uncertainties to market volatility.

Successfully navigating this landscape requires not only innovative technology but a comprehensive approach that combines rigorous security protocols, clear regulatory frameworks and adaptable economic strategies. Ultimately, the long-term success of smart contracts will depend on the ability to safeguard and stabilize them amid an ever-evolving spectrum of risks.