Saudi Arabia is gearing up to boost its global standing in investment and finance by incorporating stablecoins into its financial framework, aiming to attract more capital and support both local and international investments.

“We look forward to introducing stablecoins in the Kingdom soon, in partnership with the Capital Market Authority and the Central Bank,” said Saudi Minister of Municipal, Rural Affairs and Housing Majid Al-Hogail during his recent speech at the Global PropTech Summit 2025 in Riyadh.

Al-Hogail highlighted that leading financial centers like Dubai, Singapore, New York, London and Zurich have already implemented regulatory frameworks for stablecoins, leveraging their transparency, low transaction friction and automated verification.

He also stressed the importance of developing secure and efficient financial settlement systems, stating: “We also aim to expand participation in the regulatory sandbox to keep the Saudi real estate market among the most innovative and competitive in the world.”

What are stablecoins?

A stablecoin is a form of digital asset that can be used to make payments. Stablecoins are backed by a specified asset or basket of assets, which they use to maintain a stable value against that asset. This is usually a country’s currency, such as the U.S. dollar.

This makes stablecoins different from cryptoassets, which tend not to have assets as backing and are more volatile. With cryptoassets, like Bitcoin, their value tends to move up and down a lot in a short space of time. That is because they are not backed by real assets.

By combining the transparency and borderless nature of blockchain technology with price stability, stablecoins are emerging as a foundational layer for the new economy. They enable instant settlements, support decentralized finance (DeFi) applications and provide a reliable digital store of value. With their ability to streamline payments, lower transaction costs and promote financial inclusion, stablecoins are increasingly being adopted for faster payments, remittances and cross-border transactions.

Stablecoins to strengthen the Saudi financial ecosystem

With 79 percent of retail transactions already conducted cashlessly, Saudi Arabia is well-positioned to integrate stablecoins into its strategy to become a leading global logistics and financial hub.

Experts view the Kingdom’s pursuit of regulated, utility-focused stablecoins as a pivotal moment for the region’s digital asset landscape, underscoring Saudi Arabia’s commitment to modernization, consumer protection and financial stability. They note that, when implemented within robust regulatory frameworks and governed with transparency, stablecoins could strengthen the Saudi financial ecosystem, driving improvements in payments, trade and innovation.

Stablecoins to advance key Saudi sectors

The adoption of regulated stablecoins could bring transformative benefits to key sectors in Saudi Arabia, leveraging their stability, speed and blockchain efficiency. They have the potential to reshape the fintech and payments landscape by enabling a real-time, programmable and fully integrated financial infrastructure. Furthermore, stablecoins could facilitate instant, low-cost remittances, which is crucial for the Kingdom’s large expatriate community, surpassing traditional systems by cutting fees and settlement times.

In the logistics and e-commerce sectors, stablecoins are set to become a key driver in streamlining cross-border settlements, reducing supply chain friction and strengthening Saudi Arabia’s role as a global logistics hub.

By removing the delays and interbank fees typical of traditional card and transfer systems, consumers could experience near-instant payments. Over time, this would foster a more dynamic, cash-light economy, allowing small merchants to benefit from immediate settlements and easing their working capital pressures.

Integrating stablecoins into Saudi Arabia’s real estate sector could also enable fractional ownership of tokenized assets and attract increased global investment. Al-Hogail emphasized that stablecoins have the potential to grow the SAR300 billion real estate funds market by providing transparent, real-time access for investors to commercial, residential and land properties.

Read: Why the UAE is emerging as a global powerhouse for Bitcoin mining

Middle East advances regulatory architecture in 2025

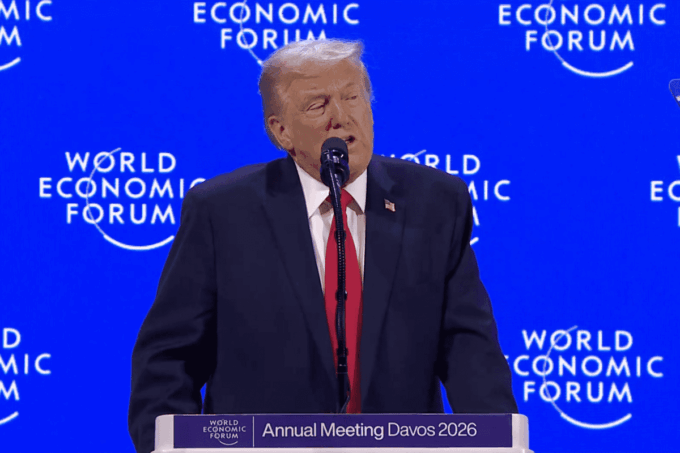

In the Middle East, 2025 was about building regulatory architecture for the region’s rapidly expanding and increasingly institutional digital asset markets. The UAE further consolidated its role as the regional hub: the Central Bank, Dubai’s VARA and Abu Dhabi’s FSRA continued to refine and operationalize mature licensing regimes for exchanges, custodians and other crypto service providers, tightened marketing, conduct and market‑integrity rules and advanced stablecoin and payment‑token frameworks that deliberately prioritize payments, settlement and tokenized finance over purely speculative use cases.

These frameworks place strong emphasis on full reserve backing, clear redemption rights and robust governance, with growing interest in local‑currency and institutionally issued stablecoins as building blocks for regulated digital‑asset markets.

Elsewhere in the Gulf, Saudi Arabia and Qatar moved beyond experimentation toward clearer policy direction: Qatar introduced a more structured digital‑asset framework, while Saudi Arabia doubled down on stablecoins, tokenization, CBDC pilots and carefully scoped DeFi‑adjacent innovation, signalling a gradual expansion of the regulatory perimeter rather than blanket permissiveness.