The MENA region has emerged as a compelling case study in cryptocurrency adoption, with transaction volumes reaching a pinnacle of over $60 billion in December 2024. Despite moderate cooling in 2025, year-over-year growth remains robust, with record monthly flows in late 2024.

This sustained growth, despite a backdrop of regional geopolitical tensions and varied economic pressures, points to the durability of cryptocurrency in the MENA financial landscape.

MENA crypto market grows 33 percent

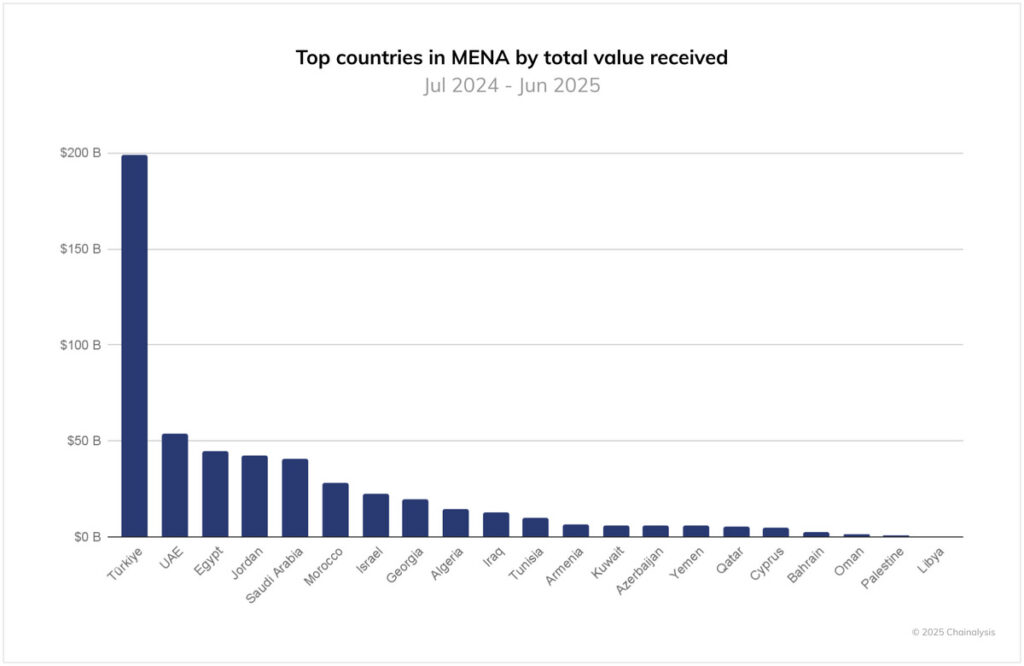

In a recent report, Chainalysis reveals that while MENA’s 33 percent period-over-period growth pales next to the growth rates seen in other developing markets such as APAC (69 percent) and Latin America (63 percent), complex dynamics in individual markets reflect how cryptocurrency can serve many different purposes, depending on unique local challenges and opportunities.

Nowhere is this more evident than in Türkiye, which occupies the top position in the regional index. Türkiye also dominates regional value received with nearly $200 billion in annual transactions, almost four times that of the UAE, which follows as the second-largest market ($53 billion).

Since early 2021, Türkiye has experienced unparalleled expansion in gross crypto inflows, reaching approximately $878 billion by mid-2025, a scale that outpaces all other regional markets, despite the country’s persistent currency devaluation and inflationary pressures.

UAE expands crypto economy with sound regulation

Amid wider regional stresses, the UAE has expanded its crypto economy with the implementation of sound regulation and macroeconomic policy. In the 2024-2025 reporting window, the UAE economy received upward of $56 billion in value, growing at 33 percent period-over-period. And while this rate of growth is slower than the 86.4 percent growth rate in the previous period-over-period cycle, it still demonstrates steady continuity in the country’s crypto economy.

Additionally, a closer examination of transfer sizes reveals a divergence between general crypto usage and merchant services adoption in the UAE. While overall growth is predominantly driven by large institutional transactions and institutional transfers, merchant services show the opposite trend. The merchant services category demonstrates extraordinary growth across retail segments, with small retail transactions growing by 88.1 percent, large retail by 83.6 percent and professional transfers by 79.5 percent.

This countercyclical pattern suggests a fundamental shift in the UAE’s cryptocurrency ecosystem, with everyday commercial use cases gaining momentum even as general transaction growth becomes increasingly concentrated among institutional players. The robust expansion of merchant services across smaller transaction sizes indicates that crypto is transitioning from a primarily speculative or investment vehicle to a practical payment solution with real-world utility for UAE consumers and businesses.

Read: ADGM approves USDT on TRON for regulated activities

Rise of DeFi and regulatory strides reshape the MENA crypto landscape

The MENA region is rapidly emerging as a key player in the crypto economy of the world. The region’s growth, fueled by institutional and enterprise activity, along with a strong appetite for DeFi and stablecoins, points to a likely expansion of MENA’s influence in the crypto space.

While CEXs still dominate, the rise of DeFi is also reshaping the landscape with nations like Saudi Arabia and the UAE embracing decentralized platforms. This underscores DeFi’s potential to drive financial inclusion across MENA, especially given the substantial underbanked population in the region at large.

Stablecoins and altcoins have also gained traction, especially in countries like Türkiye, where the economic environment has made stable stores of value desirable. Meanwhile, the UAE has positioned itself as a swiftly maturing and balanced crypto ecosystem, thriving under a regulatory framework that encourages innovation and a broad spectrum of local and international market participants.

Looking ahead, the regulatory strides made so far will be crucial in shaping the future of crypto in MENA. As blockchain technology, tokenization and cryptocurrency become more integral to the global financial landscape, these fast-growing markets will benefit from providing further legal and regulatory certainty to sustain growth and attract international interest, solidifying MENA’s increasingly prominent role in the global crypto ecosystem.